GLOBAL MEDICAL CARE

CORPORATE

At Best Doctors Canada, we proudly contribute to better health and better lives.

- Office hours: 9 a.m. – 5 p.m. EST

- Customer Service hours: 9 a.m. – 6 p.m. EST

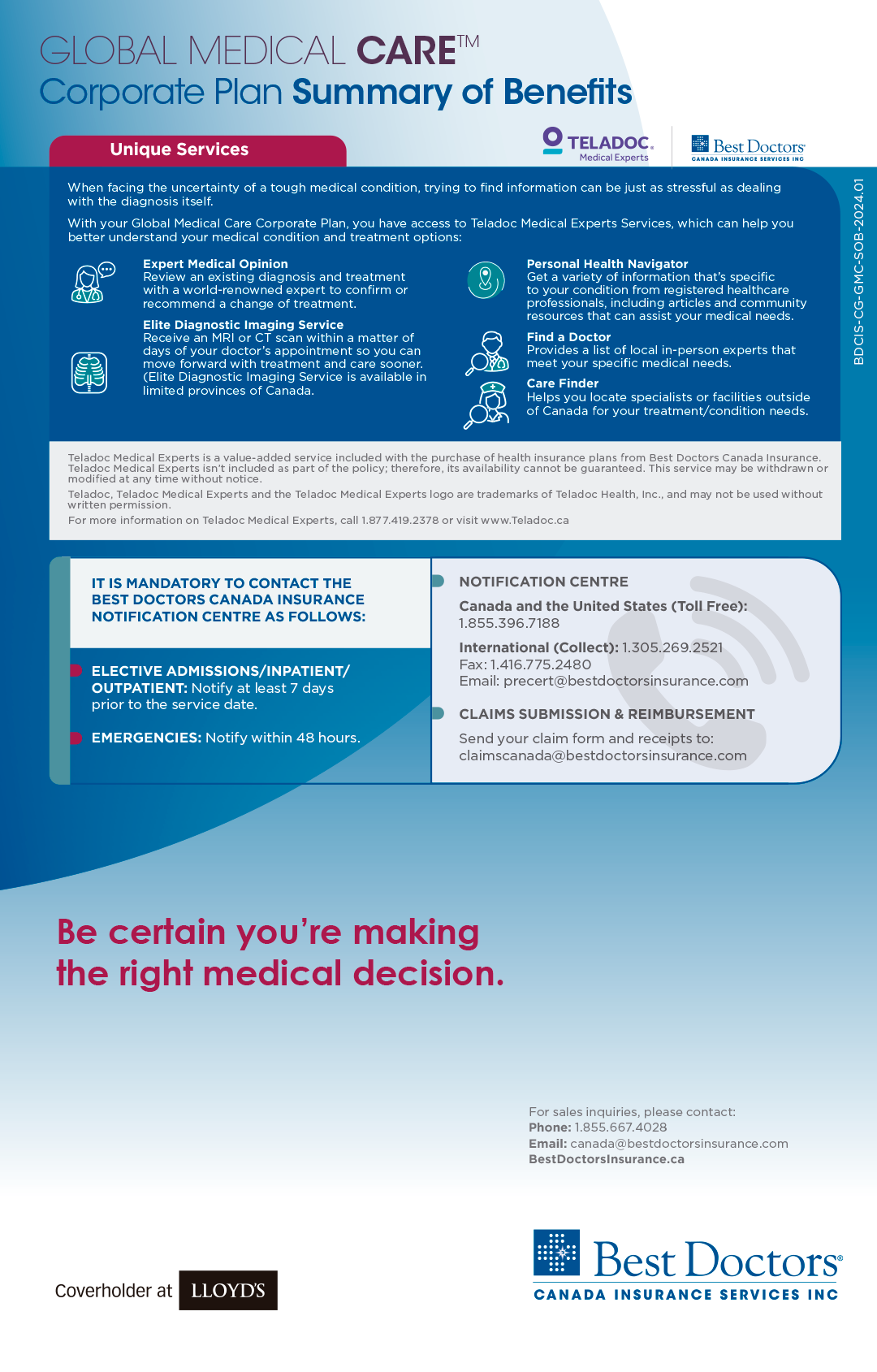

Toll Free Numbers

- Sales and general inquires: 1-855-667-4028

- Medical Notification Number: 1-855-396-7188

- Ecuador: +593-4-400-8000

- Venezuela: 58-212-720-2102

- Madrid: 34-911-88-0065

- Chile: 56-225-95-2882

- Mexico: 5255-5163-7210

- Peru: 51-1705-9741

- Brazil: 0-800-878-4070

- Trinidad & Tobago: 1-888-826-9630

- Canada: 1-855-667-4028

©2024 Best Doctors Canada. All Rights Reserved. Privacy Notice, Consumer Rights and Responsibilities and Policy holders Complaint Handling Process